Money is more than just numbers on a screen or paper in your wallet. It’s a complex psychological construct that influences our thoughts, emotions, and behaviors in profound ways. Understanding the psychology of money is crucial for anyone looking to improve their financial well-being and build a secure future.

This article delves into the fascinating world of money psychology, exploring how our mindset shapes our financial decisions and offering practical strategies to cultivate a healthier relationship with money. By the end, you’ll have a deeper understanding of your own money attitudes and the tools to transform your financial future.

Table of Contents

- Understanding the Psychology of Money

- The Impact of Emotions on Financial Decisions

- Developing a Positive Money Mindset

- Overcoming Financial Biases and Behaviors

- Strategies for Long-Term Financial Success

1. Understanding the Psychology of Money

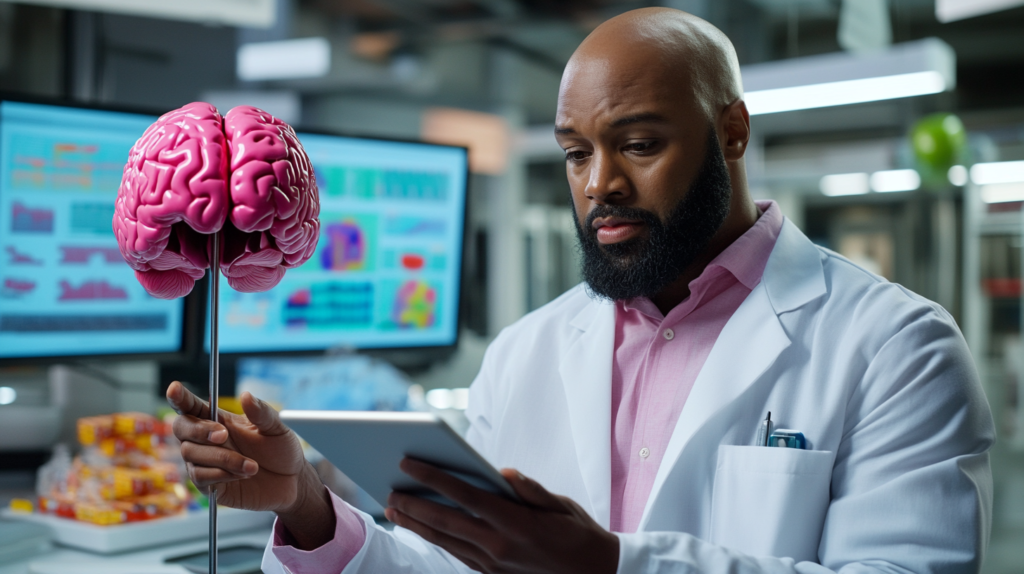

Money psychology refers to the study of how our thoughts, beliefs, and emotions influence our financial behaviors and decision-making processes. It’s a complex interplay of personal values, cultural influences, and individual experiences that shape our attitudes towards money.

Key factors that influence our money attitudes include:

- Childhood experiences and family dynamics

- Cultural and societal norms

- Personal values and life goals

- Past financial successes and failures

- Emotional associations with wealth and poverty

The impact of these psychological factors on our financial lives cannot be overstated. According to a 2019 study by the American Psychological Association, a staggering 75% of Americans experience financial stress. This pervasive anxiety can lead to poor decision-making, avoidance of financial planning, and a cycle of negative money behaviors.

Dr. Brad Klontz, a leading expert in financial psychology, explains: “Our money scripts – the unconscious beliefs about money that we inherit from our families and culture – drive our financial behaviors. Understanding and challenging these scripts is key to improving our financial well-being.”

Case Study: Dave Ramsey’s Financial Transformation

Dave Ramsey, now a well-known financial guru, offers a compelling example of how changing one’s money mindset can lead to dramatic financial transformation. In his twenties, Ramsey built a $4 million real estate portfolio, only to lose it all and file for bankruptcy by age 28.

This financial disaster forced Ramsey to confront his unhealthy money beliefs and behaviors. He realized that his drive for quick wealth and willingness to take on excessive debt were rooted in a flawed understanding of money and success. Through intensive self-reflection and education, Ramsey developed a new money philosophy based on living debt-free and building wealth slowly but surely.

By changing his money mindset, Ramsey not only rebuilt his own finances but also created a multi-million-dollar empire helping others do the same. His story illustrates the profound impact that our psychological relationship with money can have on our financial outcomes.

2. The Impact of Emotions on Financial Decisions

Our emotions play a significant role in shaping our financial decisions, often in ways we don’t fully recognize. Common emotions that affect financial choices include:

- Fear: Can lead to overly conservative investing or panic selling during market downturns

- Greed: May result in risky investments or overspending

- Anxiety: Can cause avoidance of important financial planning tasks

- Overconfidence: Might lead to underestimating risks or overestimating returns

The power of these emotions is evident in investor behavior. A 2020 study by Fidelity Investments found that 80% of investors make impulsive financial decisions due to emotions. This emotional decision-making can have serious consequences for long-term financial health.

Nobel laureate Dr. Daniel Kahneman, renowned for his work on decision-making under uncertainty, notes: “People exaggerate their ability to forecast the future, which fosters optimistic overconfidence. In other words, we think we’re better at guessing than we actually are.”

Real-World Example: Emotional Investing During Market Volatility

The COVID-19 pandemic-induced market crash of March 2020 provides a stark illustration of emotional investing. As global stock markets plummeted, many investors, driven by fear and panic, sold their holdings at significant losses. However, those who managed to control their emotions and stay invested saw their portfolios recover and even grow as markets rebounded in the following months.

Data analysis of investor behavior during this period reveals a clear correlation between emotional reactivity and poor investment outcomes. Investors who made frequent trades during the high-volatility period underperformed the market by an average of 5.5% over the following year, compared to those who maintained a buy-and-hold strategy.

This example underscores the importance of emotional regulation in financial decision-making and the potential costs of allowing fear or panic to drive investment choices.

3. Developing a Positive Money Mindset

A positive money mindset is characterized by:

- A belief in abundance rather than scarcity

- Confidence in one’s ability to manage money effectively

- A focus on long-term financial goals rather than short-term gratification

- A willingness to learn and adapt financial strategies

- A balanced approach to spending and saving

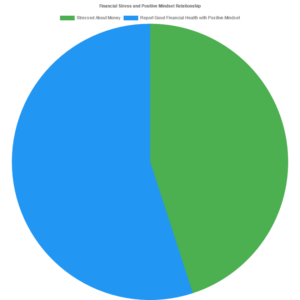

Cultivating such a mindset can have profound effects on financial well-being. According to the same Fidelity study mentioned earlier, 60% of individuals with a positive money mindset reported feeling more confident about their finances, regardless of their actual financial situation.

Dr. Elizabeth Dunn, a professor of psychology at the University of British Columbia and co-author of “Happy Money,” explains: “How we think about money can be just as important as how much we have. People who view money as a tool for creating positive experiences and helping others tend to be happier and make better financial decisions.”

Case Study: Sarah’s Mindset Shift

Sarah, a 32-year-old marketing professional, struggled with chronic overspending and credit card debt. Her negative money mindset, characterized by a belief that she would “never be good with money,” perpetuated a cycle of financial stress and poor decision-making.

After attending a financial wellness workshop, Sarah began to challenge her limiting beliefs about money. She started by keeping a “money journal” to track her spending and the emotions associated with each purchase. This practice helped her identify patterns of emotional spending and develop healthier coping mechanisms.

Over the course of a year, Sarah:

- Paid off $15,000 in credit card debt

- Increased her savings rate from 2% to 15% of her income

- Started investing in low-cost index funds for long-term growth

Sarah attributes her financial turnaround to her shift in mindset. By viewing money as a tool for achieving her goals rather than a source of stress, she was able to make more intentional and positive financial choices.

4. Overcoming Financial Biases and Behaviors

Our financial decisions are often influenced by cognitive biases – systematic errors in thinking that can lead to irrational choices. Some common financial biases include:

- Loss aversion: The tendency to prefer avoiding losses over acquiring equivalent gains

- Confirmation bias: Seeking out information that confirms our existing beliefs while ignoring contradictory evidence

- Anchoring: Relying too heavily on the first piece of information encountered when making decisions

- Herd mentality: Following the financial behaviors of others without proper analysis

Recognizing these biases is the first step in overcoming them. Strategies for mitigating their impact include:

- Educating yourself about common financial biases

- Seeking diverse perspectives before making important financial decisions

- Using data and objective criteria to evaluate financial choices

- Implementing a systematic decision-making process for major financial moves

A study published in the Journal of Economic Psychology found that investors who received training on cognitive biases improved their investment returns by an average of 3% annually compared to a control group.

Dr. Terrance Odean, a behavioral finance expert at the University of California, Berkeley, notes: “The key to overcoming financial biases is not to try to eliminate them entirely – that’s impossible – but to create systems and habits that help us make better decisions despite our biases.”

Real-World Example: Overcoming the “Hot Hand” Fallacy

The “hot hand” fallacy is a cognitive bias where people believe that a person who has experienced success with a random event has a greater chance of further success in additional attempts. This bias is particularly prevalent in investing, where it can lead to overconfidence and excessive risk-taking.

John, a retail investor, fell prey to this bias during the cryptocurrency boom of 2017. After making significant gains on his initial Bitcoin investment, John became convinced that he had a “knack” for picking winning cryptocurrencies. He began investing heavily in various alt-coins, often based on little more than online hype and his perceived hot streak.

When the crypto market crashed in 2018, John lost over 70% of his portfolio value. This painful experience led him to reassess his investment approach. He educated himself about cognitive biases, particularly the hot hand fallacy, and implemented a more disciplined, research-based investment strategy.

By acknowledging and actively working to overcome his biases, John was able to rebuild his portfolio with a more balanced and rational approach to risk management.

5. Strategies for Long-Term Financial Success

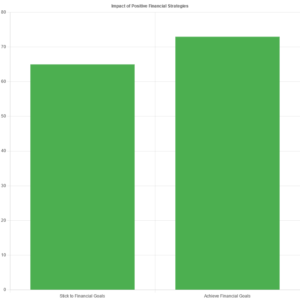

Cultivating a healthy money mindset and overcoming biases are crucial steps toward long-term financial success. Here are some practical strategies to help you on this journey:

- Educate yourself continuously: Stay informed about personal finance topics and economic trends.

- Practice mindful spending: Before making purchases, pause to consider whether they align with your values and long-term goals.

- Automate good financial habits: Set up automatic savings and investment contributions to remove emotion from the equation.

- Develop a long-term perspective: Focus on your ultimate financial goals rather than short-term market fluctuations or peer comparisons.

- Seek professional advice: Consider working with a financial advisor who can provide objective guidance and help you stay accountable.

- Regularly review and adjust your financial plan: As your life circumstances change, so should your financial strategies.

A study by the National Endowment for Financial Education found that individuals who engage in long-term financial planning are 2.5 times more likely to feel “very confident” about reaching their financial goals compared to those who don’t plan ahead.

Dr. Kristy Archuleta, a financial therapy expert, emphasizes the importance of resilience: “Building financial resilience isn’t just about having a large emergency fund. It’s about developing the mental and emotional capacity to navigate financial challenges and stay focused on your long-term objectives.”

Case Study: The Power of Consistent, Long-Term Planning

Meet Alex and Maria, a couple in their early 30s who embraced long-term financial planning from the start of their relationship. Despite moderate incomes, they prioritized the following strategies:

- Living below their means and saving 20% of their income

- Maximizing retirement account contributions

- Investing in low-cost index funds for long-term growth

- Continuously educating themselves about personal finance

After 15 years of consistent planning and disciplined execution, Alex and Maria have:

- Paid off their mortgage 10 years early

- Accumulated a retirement portfolio worth over $800,000

- Built a six-month emergency fund

- Established college savings accounts for their two children

Their success isn’t due to extraordinary income or market-beating investment returns. Instead, it’s the result of a positive money mindset, consistent good habits, and a long-term perspective. By focusing on what they could control and staying committed to their plan, Alex and Maria have built a strong financial foundation that provides both security and opportunities for the future.

Conclusion

The psychology of money plays a pivotal role in shaping our financial futures. By understanding the complex interplay of emotions, beliefs, and behaviors that influence our money decisions, we can take proactive steps to improve our financial well-being. Developing a positive money mindset, recognizing and overcoming cognitive biases, and implementing strategies for long-term success are all crucial components of this journey.

Remember, transforming your relationship with money is not an overnight process. It requires self-reflection, continuous learning, and consistent effort. However, the rewards – reduced financial stress, increased confidence, and improved financial outcomes – are well worth the investment.

As you move forward, consider how the insights from this article apply to your own financial life. What beliefs or behaviors might be holding you back? How can you cultivate a more positive and productive relationship with money? By asking these questions and taking action on the answers, you can begin to reshape your financial future in powerful ways.

Now What?

Ready to transform your money mindset and take control of your financial future? Start by taking our free Money Mindset Assessment Quiz. This 5-minute quiz will help you identify your current money attitudes and provide personalized recommendations for improvement. Click Here to book a Free Consultation today and take the first step towards a healthier, more prosperous relationship with money.