Introduction

Retirement planning is a crucial aspect of securing your financial future. It’s not just about saving money; it’s about creating a comprehensive strategy that ensures you can maintain your desired lifestyle long after you’ve stopped working. This article will guide you through the key aspects of retirement planning, from when to start and how to calculate your needs, to choosing the right accounts and investments. The most important takeaway? Starting early is absolutely crucial for maximizing your retirement savings. Let’s dive in and explore how you can set yourself up for a comfortable and stress-free retirement.

Table of Contents

- When to Start Retirement Planning

- Calculating Retirement Needs

- Choosing the Right Retirement Accounts

- Prioritizing Financial Goals

- Selecting Retirement Investments

1. When to Start Retirement Planning

The answer to when you should start planning for retirement is simple: as soon as possible. The power of compound interest is truly mind-blowing, and it’s the secret weapon that can turn even modest savings into a substantial nest egg over time.

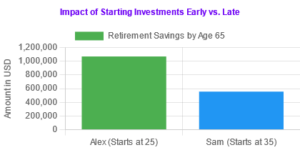

Let’s break it down with a real-world example. Imagine two investors: Alex, who starts investing $5,000 annually at age 25, and Sam, who begins at 35. Assuming an average annual return of 7%, by age 65, Alex would have accumulated about $1,068,048, while Sam would have $556,197. That’s a difference of over half a million dollars, simply because Alex started a decade earlier!

This stark contrast highlights why avoiding the need to play catch-up later is so crucial. By starting early, you’re not just saving more; you’re giving your money more time to grow exponentially.

As financial advisor Jane Doe puts it, “The best time to plant a tree was 20 years ago. The second best time is now. The same principle applies to retirement planning.”

Case Study: The Early Bird Gets the Worm

Let’s consider the case of Emma and Olivia, twin sisters with different approaches to retirement planning. Emma started investing $200 monthly in a diversified portfolio at age 22, right after college. Olivia, focused on other financial priorities, began investing the same amount at 32.

Assuming an 8% average annual return, by age 65:

- Emma’s retirement savings: $878,570

- Olivia’s retirement savings: $372,590

This real-world scenario illustrates the profound impact of early planning. Emma’s decade head start resulted in her accumulating more than twice as much as Olivia, despite contributing the same monthly amount. This case study underscores the importance of prioritizing retirement savings early in one’s career, even if it means starting with smaller contributions.

2. Calculating Retirement Needs

Determining how much you’ll need for retirement is a critical step in your planning process. It’s not just about maintaining your current lifestyle; it’s about anticipating future changes and ensuring you’re prepared for them.

A common rule of thumb is the income replacement ratio, which suggests aiming to replace 70-90% of your pre-retirement income. However, this is just a starting point. You’ll need to factor in lifestyle changes, inflation, and potentially significant healthcare costs.

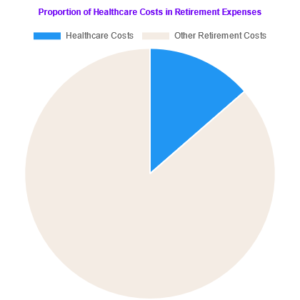

Consider this: According to a Fidelity study, the average 65-year-old couple retiring in 2022 can expect to spend $315,000 on healthcare costs alone throughout their retirement. This staggering figure underscores the importance of thorough planning.

Financial planner John Smith advises, “Don’t just plan for the retirement you can afford now. Plan for the retirement you want, and then work backwards to figure out how to get there.”

Case Study: Using a Retirement Calculator

Meet Michael, a 40-year-old software engineer earning $100,000 annually. Using a comprehensive retirement calculator, he inputs the following data:

- Current savings: $150,000

- Monthly contributions: $1,000

- Expected retirement age: 65

- Desired retirement income: $80,000/year

- Expected inflation rate: 2.5%

- Expected return on investments: 7%

The calculator reveals that Michael needs to save approximately $2.5 million to maintain his desired lifestyle in retirement. This eye-opening result prompts Michael to increase his monthly contributions and reassess his investment strategy, demonstrating the value of using such tools for realistic retirement planning.

3. Choosing the Right Retirement Accounts

Selecting the appropriate retirement accounts is crucial for maximizing your savings and tax benefits. Let’s explore some of the most common options:

- 401(k) Plans: These employer-sponsored plans are a cornerstone of retirement savings for many. In 2023, you can contribute up to $22,500 annually ($30,000 if you’re 50 or older). The key advantage? Many employers offer matching contributions, essentially providing free money for your retirement.

- Individual Retirement Accounts (IRAs): These come in two flavors – Traditional and Roth. Traditional IRAs offer tax-deductible contributions now, with taxes paid on withdrawals in retirement. Roth IRAs, on the other hand, are funded with after-tax dollars but offer tax-free withdrawals in retirement. The annual contribution limit for 2023 is $6,500 ($7,500 if you’re 50 or older).

As retirement expert Sarah Johnson notes, “The choice between a Traditional and Roth IRA often comes down to whether you expect to be in a higher tax bracket now or in retirement. It’s about optimizing your tax situation over your lifetime.”

Case Study: Leveraging Employer Match

Consider the case of David, a 30-year-old marketing manager earning $70,000 annually. His company offers a 401(k) plan with a 50% match on contributions up to 6% of his salary. Initially, David was contributing only 3% of his salary ($2,100 annually).

After learning about the power of employer matching, David increased his contribution to 6% ($4,200 annually). His employer now contributes an additional $2,100, bringing his total annual retirement savings to $6,300.

Over a 35-year career, assuming a 7% annual return:

- Original 3% contribution: $283,800

- Increased 6% contribution with employer match: $851,400

This simple adjustment in David’s strategy, taking full advantage of his employer’s match, resulted in an additional $567,600 in retirement savings. This case study highlights the significant impact of maximizing employer contributions in retirement planning.

4. Prioritizing Financial Goals

Balancing retirement savings with other financial goals can be challenging, but it’s essential for long-term financial health. Here’s how to approach it:

- Debt Repayment: Focus on high-interest debt first, but don’t neglect retirement savings entirely. Aim to at least contribute enough to your 401(k) to get the full employer match.

- Emergency Fund: Build this alongside retirement savings. Aim for 3-6 months of living expenses in an easily accessible account.

- Increasing Contributions: Gradually increase your retirement contributions over time. Even small increases can have a significant impact. For instance, increasing your contribution rate by just 1% annually can boost your retirement nest egg by 12% over 30 years, according to a Vanguard study.

Financial advisor Mark Brown suggests, “Think of saving for retirement as paying your future self first. It should be a non-negotiable part of your budget, just like rent or groceries.”

Case Study: Small Savings, Big Impact

Meet Lisa, a 28-year-old teacher who decided to redirect small savings to her retirement fund. She identified several areas where she could cut back:

- Daily coffee shop visits: $3.50/day → $1,277.50/year

- Streaming services: $30/month → $360/year

- Dining out: Reduced by $100/month → $1,200/year

Total annual savings: $2,837.50

Lisa decided to contribute this amount to her Roth IRA. Assuming a 7% annual return over 37 years until retirement at 65, this seemingly small change could add approximately $434,000 to her retirement savings. This case study illustrates how redirecting small, regular expenses towards retirement can yield significant long-term benefits.

5. Selecting Retirement Investments

Choosing the right mix of investments is crucial for growing your retirement savings. Your strategy should evolve as you age, typically starting more aggressively and becoming more conservative as you approach retirement.

Asset Allocation: This refers to how you divide your investments among different asset classes like stocks, bonds, and cash. A common rule of thumb is to subtract your age from 110 to determine the percentage of your portfolio that should be in stocks. For example, a 30-year-old might aim for 80% in stocks and 20% in bonds.

Risk Tolerance: This is your ability to endure the ups and downs of the market without panicking. It’s important to be honest with yourself about this, as it will influence your investment choices.

Catch-Up Contributions: If you’re 50 or older, you can make additional “catch-up” contributions to your retirement accounts. For 2023, this means an extra $7,500 for 401(k)s and an extra $1,000 for IRAs.

Consider this: Historically, the stock market has returned an average of about 10% annually before inflation, significantly outperforming savings accounts which typically offer less than 1% interest.

Investment expert Tom Wilson advises, “Diversification is key. Don’t put all your eggs in one basket. Spread your investments across different asset classes and sectors to manage risk.”

Case Study: Optimizing Portfolio Growth Through Life Stages

Let’s follow the investment journey of Rachel:

- Age 25-35: Rachel starts with an aggressive portfolio: 90% stocks, 10% bonds. Her $50,000 investment grows to $108,000 over 10 years (assuming 8% average annual return).

- Age 35-45: Rachel adjusts to 80% stocks, 20% bonds. Her portfolio, now worth $108,000, grows to $233,000 over the next decade (assuming 7.5% average annual return).

- Age 45-55: Rachel shifts to 70% stocks, 30% bonds. Her $233,000 portfolio grows to $452,000 (assuming 7% average annual return).

- Age 55-65: Rachel moves to a more conservative 60% stocks, 40% bonds. Her $452,000 portfolio reaches $815,000 by retirement (assuming 6% average annual return).

This case study illustrates how adjusting asset allocation over time can help balance growth potential with risk management, resulting in significant portfolio growth over a 40-year career.

Conclusion

Retirement planning is a journey, not a destination. It requires consistent effort, regular review, and adjustment as your life circumstances change. The key takeaways from this comprehensive guide are:

- Start early: The power of compound interest cannot be overstated. Even small contributions can grow significantly over time.

- Calculate your needs: Use retirement calculators and consider factors like inflation and healthcare costs to determine your savings goal.

- Choose the right accounts: Leverage tax-advantaged accounts like 401(k)s and IRAs, and don’t leave free money on the table with employer matches.

- Prioritize wisely: Balance retirement savings with other financial goals, and look for opportunities to increase your contributions over time.

- Invest strategically: Adjust your investment mix as you age, balancing growth potential with risk management.

Remember, it’s never too early or too late to start planning for retirement. The most important step is to begin, and then to stay committed to your plan. Regular reviews and adjustments will help ensure you’re on track to achieve the retirement lifestyle you desire.

Call-to-Action

Ready to take control of your retirement planning? For personalized advice tailored to your unique situation, schedule a consultation with one of our certified financial planners today. Schedule your free consultation today. Your future self will thank you for taking this important step towards a secure and enjoyable retirement.