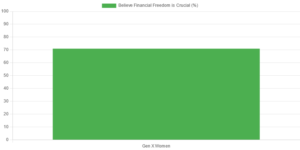

Financial freedom is a critical goal for Gen X women, born between 1965 and 1980. As they navigate mid-career challenges, family responsibilities, and retirement planning, achieving financial independence has become increasingly important. According to a recent study by Bank of America, 71% of Gen X women believe financial freedom is essential to their overall well-being. However, many face significant obstacles in reaching this goal.

Expert financial advisor Suze Orman emphasizes, “Financial freedom is about understanding your relationship with money and making it work for you, not against you.” This article explores key strategies and insights to help Gen X women overcome financial challenges and pave their way to a secure financial future.

Table of Contents

- Understanding Financial Freedom

- Building a Solid Financial Foundation

- Achieving Financial Freedom Through Investing

- Overcoming Financial Challenges

- Creating a Personalized Financial Plan

1. Understanding Financial Freedom

Financial freedom is more than just having enough money to cover expenses; it’s about having the flexibility and security to make choices that align with your values and goals. For Gen X women, this concept takes on added significance as they balance career advancement, family responsibilities, and long-term financial planning.

The key components of financial freedom include:

- Debt-free living

- Robust emergency savings

- Diversified investments

- Passive income streams

- Adequate retirement savings

According to the Bank of America study, 71% of Gen X women believe financial freedom is crucial to their overall well-being. This statistic underscores the importance of prioritizing financial independence in their lives.

Suze Orman, a renowned financial expert, emphasizes the psychological aspect of financial freedom: “True financial freedom is when you have power over your fears and anxieties instead of the other way around.”

Case Study: Emily, 35-year-old software engineer

Emily, a software engineer in her mid-30s, realized the importance of financial freedom when she found herself stuck in a toxic work environment. Despite a high salary, she felt trapped due to substantial student loan debt and a lack of savings. This experience motivated her to take control of her finances.

Emily started by creating a budget and aggressively paying down her debt. She also began educating herself about investing and building multiple income streams. Within three years, she had paid off her student loans, built a six-month emergency fund, and started investing in index funds and real estate.

Today, Emily feels empowered by her financial choices. She has the flexibility to consider career changes without fear and is on track to retire comfortably. Her journey illustrates how understanding and prioritizing financial freedom can lead to increased life satisfaction and opportunities.

2. Building a Solid Financial Foundation

Establishing a strong financial foundation is crucial for Gen X women seeking financial freedom. This foundation serves as the bedrock for future wealth-building and provides stability during uncertain times.

Key steps in building a solid financial foundation include:

- Creating and sticking to a realistic budget

- Aggressively paying down high-interest debt

- Building an emergency fund covering 3-6 months of expenses

- Maximizing employer-sponsored retirement accounts

- Securing adequate insurance coverage

Despite the importance of these steps, many Gen X women face challenges in implementing them. The National Foundation for Credit Counseling’s 2020 Survey on Financial Wellness revealed that 64% of Gen X women haven’t started building an emergency fund. This statistic highlights a significant gap in financial preparedness among this demographic.

Financial expert Dave Ramsey emphasizes the importance of this foundation: “You must gain control over your money or the lack of it will forever control you.”

Case Study: Rachel, 42-year-old teacher

Rachel, a 42-year-old high school teacher, struggled with budgeting and saving throughout her 30s. With two young children and a mortgage, she often felt overwhelmed by financial pressures.

Determined to change her situation, Rachel started by tracking her expenses for a month. She was shocked to discover how much she was spending on non-essentials. Using this information, she created a realistic budget that prioritized debt repayment and savings.

Rachel and her husband committed to a “no-spend” challenge for three months, directing all extra money towards their credit card debt. They also automated their savings, setting up direct deposits into an emergency fund account.

Within a year, Rachel had paid off her credit cards and built a two-month emergency fund. She then increased her retirement contributions and started a 529 college savings plan for her children.

Rachel’s story demonstrates how building a solid financial foundation can transform one’s financial outlook and provide peace of mind, even on a modest income.

3. Achieving Financial Freedom Through Investing

Investing is a crucial component of achieving long-term financial freedom for Gen X women. By harnessing the power of compound interest and market growth, investing can help build wealth over time and provide financial security in retirement.

Key investment options for Gen X women include:

- Stock market investments (individual stocks, mutual funds, ETFs)

- Real estate (rental properties, REITs)

- Retirement accounts (401(k)s, IRAs)

- Business ventures or side hustles

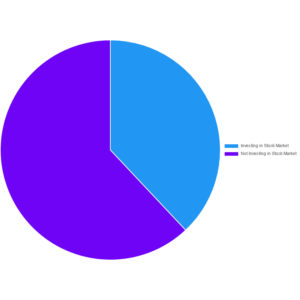

However, the Bank of America study found that 62% of Gen X women are not investing in the stock market. This statistic reveals a significant missed opportunity for wealth building among this demographic.

Financial expert Farnoosh Torabi emphasizes the importance of investing for women: “Investing is not optional. It’s essential to growing your wealth and securing your financial future.”

Common investing mistakes to avoid:

- Waiting too long to start investing

- Not diversifying investments

- Trying to time the market

- Letting emotions drive investment decisions

- Neglecting to rebalance portfolios regularly

Case Study: Sarah, 38-year-old marketing manager

Sarah, a 38-year-old marketing manager, was intimidated by the stock market and had avoided investing beyond her company’s 401(k). After attending a financial workshop, she realized she was missing out on significant growth potential.

Sarah started by educating herself about investing through books, podcasts, and online courses. She then opened a brokerage account and began investing in low-cost index funds, allocating a portion of her monthly income to investments.

As her confidence grew, Sarah diversified her portfolio to include individual stocks in sectors she understood well. She also explored real estate investing, purchasing a small rental property in her area.

Within five years, Sarah’s investment portfolio had grown significantly, outpacing her savings account returns. She now feels more confident about her financial future and is on track to retire comfortably.

Sarah’s experience illustrates how overcoming investment fears and taking calculated risks can lead to substantial financial growth and increased confidence in one’s financial future.

4. Overcoming Financial Challenges

Gen X women often face unique financial challenges that can hinder their path to financial freedom. Recognizing these obstacles and developing strategies to overcome them is crucial for long-term financial success.

Common financial challenges for Gen X women include:

- Balancing career advancement with family responsibilities

- Managing the financial impact of divorce or single parenthood

- Caring for aging parents while supporting children

- Overcoming the gender pay gap

- Catching up on retirement savings

The 2020 Survey on Financial Wellness by the National Foundation for Credit Counseling revealed that 45% of Gen X women have less than $1,000 in savings. This statistic underscores the urgent need for financial education and support among this demographic.

Financial expert Rachel Cruze emphasizes the importance of addressing these challenges: “Your financial situation is not going to change unless you make a plan and take action.”

Strategies for overcoming financial challenges:

- Seek professional financial advice

- Prioritize financial education and skill development

- Negotiate for better pay and benefits

- Explore flexible work arrangements

- Develop multiple income streams

- Leverage technology for budgeting and investing

Case Study: Lisa, 40-year-old small business owner

Lisa, a 40-year-old small business owner, faced significant financial challenges after her divorce. With two young children and a struggling business, she felt overwhelmed by her financial responsibilities.

Lisa started by seeking the help of a financial advisor who specialized in working with divorced women. Together, they created a comprehensive financial plan that included restructuring her business finances, creating a personal budget, and developing a strategy for rebuilding her savings.

To increase her income, Lisa expanded her business offerings and took on consulting work. She also enrolled in financial education courses to improve her money management skills.

Within two years, Lisa had stabilized her business, rebuilt her emergency fund, and started contributing to her retirement accounts again. She now feels more confident in her ability to provide for her family and secure her financial future.

Lisa’s story demonstrates how seeking professional help, prioritizing financial education, and taking proactive steps can help overcome even significant financial challenges.

5. Creating a Personalized Financial Plan

Developing a tailored financial strategy is crucial for Gen X women to achieve their unique financial goals and navigate their specific life circumstances. A personalized plan provides a roadmap for financial success and helps maintain focus on long-term objectives.

Steps to develop a personalized financial plan:

- Define clear, measurable financial goals

- Assess current financial situation (income, expenses, assets, liabilities)

- Identify areas for improvement and growth

- Create a realistic budget and savings plan

- Develop an investment strategy aligned with goals and risk tolerance

- Implement the plan and track progress

- Regularly review and adjust the plan as needed

Despite the importance of financial planning, the Bank of America study found that 55% of Gen X women have not started saving for retirement. This statistic highlights the urgent need for comprehensive financial planning among this demographic.

Financial expert Farnoosh Torabi emphasizes the importance of personalized planning: “Your financial plan should be as unique as you are. It’s not about following a one-size-fits-all approach, but rather creating a strategy that aligns with your specific goals and circumstances.”

Tools and resources for financial planning:

- Budgeting apps (e.g., YNAB, Mint)

- Investment platforms (e.g., Vanguard, Fidelity)

- Retirement calculators

- Financial planning software

- Professional financial advisors

Case Study: Jennifer, 44-year-old healthcare professional

Jennifer, a 44-year-old nurse practitioner, realized she needed a comprehensive financial plan when she started thinking about her retirement goals. Despite a good income, she felt uncertain about her financial future.

Jennifer started by listing her financial goals, which included paying off her mortgage early, funding her children’s college education, and retiring at 60. She then gathered all her financial information and used online tools to assess her current situation.

Working with a financial advisor, Jennifer created a detailed plan that included increasing her retirement contributions, opening 529 plans for her children, and refinancing her mortgage to a shorter term. She also developed an investment strategy that aligned with her goals and risk tolerance.

Jennifer set up automatic contributions to her various savings and investment accounts and committed to reviewing her plan quarterly. She also started tracking her expenses more closely and found areas where she could cut back to increase her savings rate.

Within a year of implementing her plan, Jennifer felt more confident about her financial future. She was on track with her savings goals and had a clear roadmap for achieving financial freedom.

Jennifer’s experience illustrates how creating and following a personalized financial plan can provide clarity, direction, and confidence in one’s financial journey.

Conclusion

Achieving financial freedom is a critical goal for Gen X women, requiring dedication, education, and strategic planning. By understanding the components of financial freedom, building a solid foundation, leveraging investing opportunities, overcoming challenges, and creating personalized financial plans, Gen X women can take control of their financial futures.

The journey to financial freedom may seem daunting, but it’s achievable with the right mindset and tools. Remember that small, consistent steps can lead to significant progress over time. Whether it’s starting an emergency fund, increasing retirement contributions, or seeking professional advice, every action towards financial security is valuable.

As the case studies in this article demonstrate, women from various backgrounds and circumstances can overcome financial obstacles and build paths to financial freedom. By prioritizing financial education, setting clear goals, and taking proactive steps, Gen X women can secure their financial futures and gain the flexibility and peace of mind that come with true financial independence.

Call-to-Action

Ready to take control of your financial future? Don’t let another day pass without taking action towards your financial freedom. Schedule your free consultation today with our expert financial advisors to create a personalized plan tailored to your unique needs and goals. Start your journey to financial security today – your future self will thank you!